NEW Voluntary Benefits Open Enrollment: 8/23/23 - 8/25/23

As a member of USW at International Paper, you are eligible to participate in our Voluntary Benefits Program. Voluntary Benefits are offered to help address the individual needs of you and your family with advantages that otherwise might not be available to you on your own. Your voluntary benefit offerings are designed to complement your benefits package and provide additional security for you and your family.

A Premier Worksite Benefits representative will be onsite, on the following dates/times, in the Cafeteria to explain these valuable benefits, answer questions and enroll those who wish to participate.

Wednesday, August 23rd – Friday, August 25th, 2023: 7am—12pm and 3pm—7pm

Benefits are available to eligible Union Members through the convenience of premium deduction from your Checking Account and may be continued if you leave employment or retire – you will need to provide account and routing number along with a VOIDED check (if participating).

What do you get?

Options: You may choose your level of coverage; one that both fits your needs and is easy on your paycheck. Your decision will not change the benefits being provided under any employer-sponsored benefit program.

Convenience: Voluntary benefits are paid through the convenience of payroll deduction

Acceptance: In many cases, you and immediate family members will have a better opportunity to obtain coverage through this offering than you would on your own, especially if any medical conditions or concerns are present.

Portability: Many of these programs may be taken with you with no change in premium or benefit if you leave employment or retire.

Contact Us

Premier Worksite Benefits

P: (866) 463-8808, Option 4

Mon-Fri 9am-4pm EST

support@premierworksite.com

Permanent Life Insurance

Life Insurance helps take care of your loved one’s immediate and future financial needs following your death. Immediate needs can include burial/funeral expenses, uninsured medical costs and current bills and debts. Future needs could include income replacement, education plans, ongoing family obligations, emergency funds, and retirement expenses.

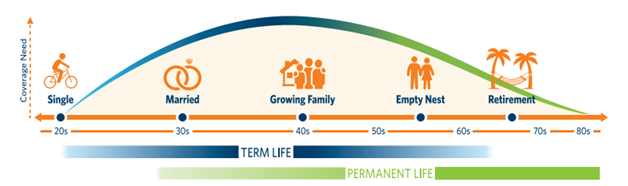

As people move through the stages of life, certain factors dictate the type of life insurance they need. During working years, an employer may provide Term Life insurance, but the Unum Whole Life product is designed to last for the remainder of your life and can help give peace of mind because the money you spend builds cash value that you can use later in life or add to the term benefit payout. The graph below illustrates the need for term and permanent whole life insurance throughout the various stages of life.

Accident Insurance with Disability Sickness Rider

Unexpected accidents can also mean unexpected out-of-pocket expenses. Hospital stays, medical or surgical treatments, dislocations or fractures, and transportation by ambulance can add up quickly and be very costly. Accident Insurance can help with some of these expenses so your finances can remain healthy.

Accident/Sickness/Disability Benefits (Guaranteed Issue – No Medical Questions) – Tax Free income paid if a member becomes disabled due to a covered accident or sickness that occurs BOTH ON-AND-OFF the job. This plan pays IN ADDITION to our company provided accident and sickness benefit, workers comp and social security benefits with NO OFFSETS! Benefit payments can last up to 12 months per occurrence. Get sick or hurt, get paid.

- Coverage is guaranteed issue – you may qualify for coverage regardless of health

- Benefits are paid directly to you – use the money however you see fit

- Coverage is available to you, your spouse and dependent children

- On and off the job coverage

- Disability Sickness Rider – If the Primary Insured suffers continuous total disability as a result of Covered Sickness, a monthly benefit payout will occur (see Schedule of Benefits for details – Regular care and attendance of a physician is required).