Security Mutual Permanent Life Insurance Call Center Open Enrollment

Monday, November 25th – Friday, December 6th, 2024

As an employee of St. Joseph’s University, you are eligible to participate in our Security Mutual Life Insurance Program. The Life Insurance Program is offered to help address the individual needs of you and your family with advantages that otherwise might not be available to you on your own. Your voluntary benefit offering is designed to complement your benefits package and provide additional security for you and your family.

Benefits are available to eligible Employees through the convenience of payroll deduction and may be continued should leave employment or retire.

Please plan to speak with a Premier Worksite Benefits representative to learn more about the valuable benefit, ask questions and enroll if you choose to do so.

PREMIER WORKSITE BENEFITS CUSTOMER SERVICE

(866) 463-8808, option 4

support@premierworksite.com

(Monday – Friday, 9am – 4pm EST)

*Please note that the call center will be closed on 11/28 & 11/29 in observance of Thanksgiving.

What do you get?

Options: You may choose your level of coverage; one that both fits your needs and is easy on your paycheck. Your decision will not change the benefits being provided under any employer-sponsored benefit program.

Convenience: Voluntary benefits are paid through the convenience of payroll deduction

Acceptance: In many cases, you and immediate family members will have a better opportunity to obtain coverage through this offering than you would on your own, especially if any medical conditions or concerns are present.

Portability: Many of these programs may be taken with you with no change in premium or benefit if you leave employment or retire.

Permanent Life Insurance

Life Insurance helps take care of your loved one’s immediate and future financial needs following your death. Immediate needs can include burial/funeral expenses, uninsured medical costs and current bills and debts. Future needs could include income replacement, education plans, ongoing family obligations, emergency funds, and retirement expenses.

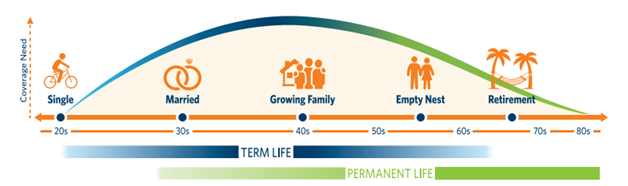

As people move through the stages of life, certain factors dictate the type of life insurance they need. During working years, an employer may provide Term Life insurance, but the Security Mutual Whole Life product is designed to last for the remainder of your life and can help give peace of mind because the money you spend builds cash value that you can use later in life or add to the term benefit payout. The graph below illustrates the need for term and permanent whole life insurance throughout the various stages of life.