Transamerica Benefits

As an employee of of Concourse Rehabilitation & Nursing Center, you are eligible to participate in our Voluntary Benefits Program. Voluntary Benefits are offered to help address the individual needs of you and your family with advantages that otherwise might not be available to you on your own. Your voluntary benefit offerings are designed to complement your benefits package and provide additional security for you and your family.

Enrolling in these valuable benefits are ONLY during the Annual Open Enrollment; employees will be notified prior to the enrollment period.

You may also contact the Premier Worksite Benefits Customer Service Center for additional support.

Phone: (866) 463-8808, Option 4

Mon-Fri 9am-4pm EST

email: support@premierworksite.com

Permanent Life Insurance

Life Insurance helps take care of your loved one’s immediate and future financial needs following your death. Immediate needs can include burial/funeral expenses, uninsured medical costs and current bills and debts. Future needs could include income replacement, education plans, ongoing family obligations, emergency funds, and retirement expenses.

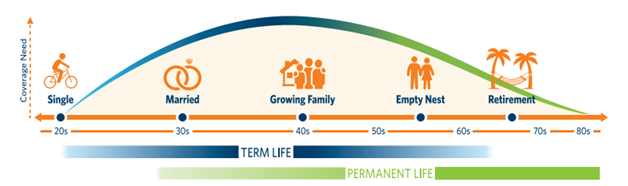

As people move through the stages of life, certain factors dictate the type of life insurance they need. During working years, an employer may provide Term Life insurance, but the Transamerica Universal Life product is designed to last for the remainder of your life and can help give peace of mind because the money you spend builds cash value that you can use later in life or add to the term benefit payout. The graph below illustrates the need for term and permanent life insurance throughout the various stages of life.

Short Term Disability

Could you survive if you were suddenly left without a paycheck? How would you pay your mortgage/rent, utilities, car insurance, car payments, food and other living expenses? Disability Insurance provides you with cash to protect your lifestyle when out of work due to an accident or illness.

- Just over 1 in 4 of today’s 20-year-olds will become disabled before they retire*

- Offers income protection to help cover monthly expenses (i.e. mortgage or rent, utilities, car payments, etc…)

if you’re unable to work because of a total disability due to illness or injury

Accident Insurance

Unexpected accidents can also mean unexpected out-of-pocket expenses. Hospital stays, medical or surgical treatments, dislocations or fractures, and transportation by ambulance can add up quickly and be very costly. Accident Insurance can help with some of these expenses so your finances can remain healthy.

- Guaranteed issue – Coverage is available to you, your spouse and dependent children regardless of health history

- Benefits are paid directly to you – use the money however you see fit

- On and off the job coverage